Town Government

Mayor and Town Board updates, Municipal Court info, and more.

Our Community

Find information on community events, town parks, and our photo gallery.

Town Services

View town services like the fire department, museum, and library.

Businesses

See a list of local businesses and apply for a business license.

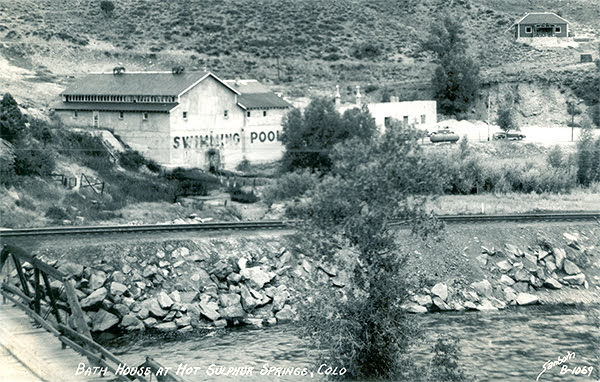

Welcome to the Town of Hot Sulphur Springs

Looking for the latest town updates? Make sure to check our Hot Topics page for the latest news we’re sharing with the community.

Have great pictures of the Town of Hot Sulphur Springs? We’d love to showcase them in our photo gallery and share with our community. From events like Town of Hot Sulphur Springs Days and Winter Festival to the beautiful sunsets and roaming wildlife, we’d love to see our town through your lens.

Committed to providing community development and board services, find out more about our local government operations.

On January 21, 2021, the Town adopted a moratorium on new development permits, approvals, and requests.

If you are starting a business, own a business, or do business in Hot Sulphur Springs please complete a Town of Hot Sulphur Springs Application for Business License.